Cash App Investing Or Robinhood

This type of stock trading is encouraging young people to. Robinhood and cash app are products born of the financial technology (or fintech) revolution.

Cash App Vs Robinhood Our In-depth Comparison 2021

R/cashapp is for discussion regarding cash app on ios and android devices.

Cash app investing or robinhood. All other account types, including trading on margin, are not supported at this time. Cash app is pretty much as simple as it gets, and is at the top of the pack, in the fintech industry, as far as simplicity is concerned, besides the acorns investing app. This type of stock trading is encouraging young people to begin investing at their own pace.

The cash app investing service launched in 2019 with the goal. Robinhood is strictly an investment app, with no guidance in portfolio selection management or live advisors. Public offers new users a free $10 stock slice.

Robinhood isn’t complicated or anything, but when facing off against investing apps that were designed specifically for simplicity, robinhood simply doesn’t win this category. You can do the most on schwab, robinhood will limit which companies you can buy but will probably give you access to options quickly if you want. Cash app investing is an online brokerage service, similar to robinhood or sofi invest.

Both platforms offer investment functions without account minimums or commissions. The investors cannot automate investment unless they are deposits to your account and is thus more suitable for active traders and not passive investors. Mobile app robinhood is primarily an investing app investing app available investing app available customer service customer support available 24/7 via phone (request on the app)

Cash app is good if you want to invest your money on simple terms without getting into anything complicated, and you’re not interested in. Robinhood offers several more features like options and instant access to cash. Are apps like cash app and robinhood good ways to start investing in the stock market?

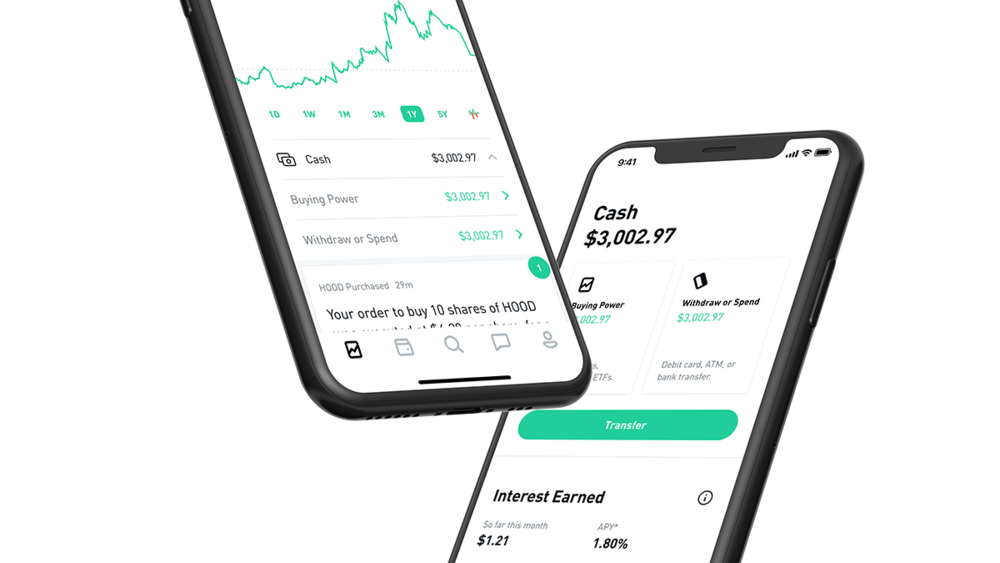

Robinhood is more of an investing platform, whereas cashapp is what we call a “swiss army knife” of moving and managing money that comes with some clever perks. However, robinhood offers more features and many more investment types than cash app investing. When it comes to investing online or on your phone, stash, acorns and robinhood are three names at the top of the industry.

Cash app allows the purchase of fractional shares, which is a really cool way for people to get started in investing for as little as one dollar, like stash has done for a bit robinhood robinhood has an amazingly fresh and user friendly platform. Kyle johansen may 27, 2020. Margin investing can provide flexibility with your cash:

Schwab is great and with no commissions is a great place to start. However, coinbase fees can take a chunk out of your investment, whereas robinhood doesn’t charge a commission, so users may pay less per trade. If you see an opportunity in the market and want to invest more, you can invest right away without needing to make a deposit from your bank.

Both platforms are excellent for beginners. Robinhood is focused primarily on stocks and etfs while cash app’s speciality is mobile payments and transactions. In early 2021, robinhood was notably in the news when a bunch of retail traders on reddit (wall street bets) stuck it to a large hedge fund over shorting gamestop stock.

Whereas m1 finance offers retirement accounts, the robinhood app does not have retirement accounts such. The margin investing feature allows you to borrow money from robinhood to purchase securities. This gives you access to additional money based on the value of certain securities in your account.

Each was designed to simplify investing for retail investors, offering straightforward apps that are easy to use and understand.while there are larger players in the brokerage space, these companies are certainly some of the most dynamic. I would recommend one those over using cash app. The biggest difference between cash app and robinhood is its simplicity and ability to purchase fractional shares.

The biggest difference between cash app and robinhood is its simplicity and ability to purchase fractional shares. If you want a mobile investing platform with more investment options: The robinhood app lets you buy and trade stocks, options, etfs.

Apps are for very naive youngsters who are clueless about the risks of investing. Investing new cash app investing: Both cash app and robinhood are aimed towards relatively inexperienced investors with a whole suite of different products.

Discounts and money exchange cash app offers many discounts and can be mainly used for discounted purchases on many outlets. For example, twitter is currently trading at $32.86 per share at the time of writing. Robinhood is ok but has its issues.

Cash App Stock Investing Review 2021

Cash App Vs Robinhood Our In-depth Comparison 2021

Cash App Stock Investing Review 2021

Cash App Investing 2021 Review Should You Open An Account The Ascent By Motley Fool

5 Things To Know About Cash Management Under The Hood

Cash App Vs Robinhood Our In-depth Comparison 2021

Can You Link Cash App To Robinhood How Does It Work

Cash App Investing Vs Robinhood App - Youtube

Cash App Vs Robinhood - Which Is Better To Invest - Youtube

Squares Cash App Officially Adds Free Stock Trading Starting At 1 - The Verge

Robinhood In Need Of Cash Raises 1 Billion From Its Investors - The New York Times

Cash App Vs Robinhood Our In-depth Comparison 2021

Robinhood Vs Cashapp Which One Is Better

Investing Update Dec 3 2020 - Cash App Webull Robinhood Outlet Finance - Youtube

Robinhood Vs Cashapp Which One Is Better

Cash App Vs Robinhood Our In-depth Comparison 2021

Cash App Vs Robinhood Our In-depth Comparison 2021

Robinhood Rival Apps Aim To Make Mobile Trading Easy For Amateur Investors Fox Business

Cash App Investing Review Look Out Robinhood Investment U

Comments

Post a Comment